nassau county property tax rate 2021

How to Challenge Your Assessment. Instantly view essential data points on Nassau County as well as NY effective tax rates median real estate taxes paid home values.

Nassau County Stats for Property Taxes.

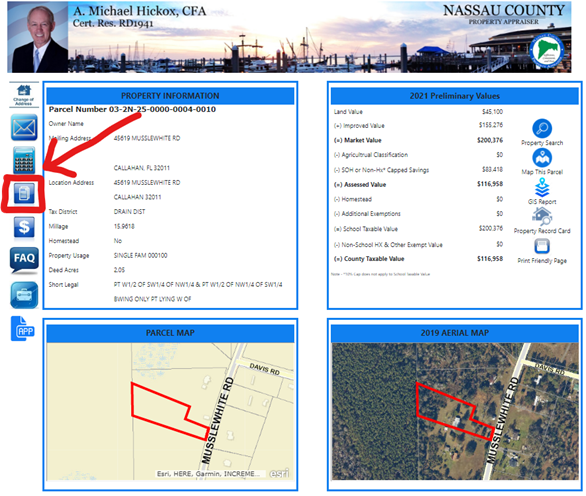

. Is responsible for developing fair and equitable assessments for all residential and commercial properties in Nassau County on an annual basis. If you have any questions his office can be reached at 904 491-7300. Fernandina Beach FL 32034.

In-depth Nassau County NY Property Tax Information. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. Look at schools on Long Island those that have bad scores is where the property taxes are low.

They will use these values to help determine their tax rate for the property owners of Nassau County later this summer. 20222023 Tentative Assessment Rolls. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value.

Remember you can only file once per year. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. These higher taxes reflect rising property values.

More than 39000 homeowners will see increases of more than 3000 while 11000 will see increases of 5000 or more. For a property assessed at 500000 the reduction would save. The tax reassessment affects 400000 residential and commercial properties in Nassau County.

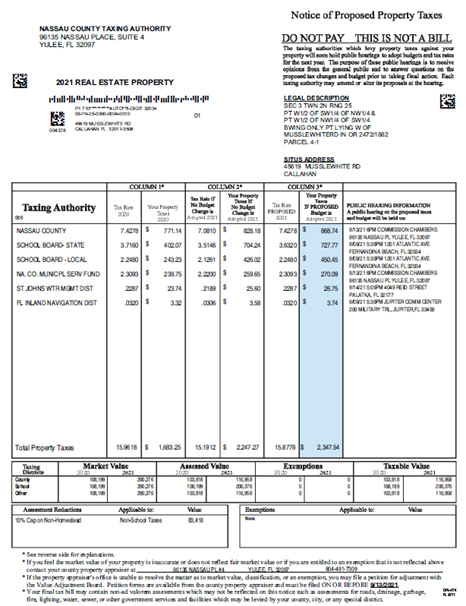

You can pay in person at any of our locations. The Notice of Proposed Property Taxes TRIM Notice informs the owner of their proposed property values exemptions and millage rates for their upcoming tax bill. I would encourage you to participate in this process.

The County sales tax rate is. It states the fair market assessed and taxable values. This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills.

Among the many different counties of New York Suffolk and Nassau counties. The Nassau County sales tax rate is 425. The New York state sales tax rate is currently 4.

20212022 Final Assessment Rolls. One-time payments to. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

It is also linked to the Countys Geographic Information System GIS to provide. Rules of Procedure PDF Information for Property Owners. Based on the CPI used for 2021 previously homesteaded properties will.

Although taxable values have increased Countywide many property owners are protected by the Save our Homes SOH Amendment which caps the amount the assessed value can increase. While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County homeowners already struggling with some of the highest property tax rates in the US. We provided the 2021 estimated values to the taxing authorities on May 28th so they can begin their budget process using these preliminary figures.

Nassau County Tax Collector. Nassau County Property Appraiser. According to the county taxes will rise for 52 of homeowners and decline for 48.

Your individual STAR credit or STAR exemption savings cannot exceed the amount of the school taxes you pay. The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown above due to either of the following reasons. In Nassau you file with the Assessment Review Commission and the deadline is March 1 2021.

The plan which will result in payments of up to 375 for qualifying residents has been approved by the Nassau County Legislature. In Suffolk residents file with the town in which they reside and the deadline is May 18 2021. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. 86130 License Road Suite 3.

Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. The typical Suffolk County homeowner pays 9157 annually in property taxes. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales.

Some Nassau County property owners are a bit surprised at their tax bills this year following a countywide reassessment. The current total local sales tax rate in Long Island City NY is 8875. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made.

The Nassau County sales tax rate is 425. Wont my property taxes go down if my assessment goes down. This is the total of state and county sales tax rates.

Nassau County Tax Lien Sale. As part of a 35 billion county budget for next year Curran has proposed a 70 million property tax reduction according to Newsday. Looking for more property tax statistics in your area.

School current tax bill for 07012021 to 06302022. If you are able please utilize our online application to file for homestead exemption. Michael Hickox Nassau County Property Appraiser.

The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents. The deadline to file is March 1 2022. Assessment Challenge Forms Instructions.

Yearly median tax in Nassau County. Cobra charges only 40 of the tax reduction secured through the assessment reduction. Homestead properties can increase no more than 3 or the consumer price index CPI whichever is lower.

This is the total of state and county sales tax rates. March 01 2021 0342 PM. The New York state sales tax rate is currently 4.

When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000.

Property Tax Exemptions Available To Residents Syosset Advance

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

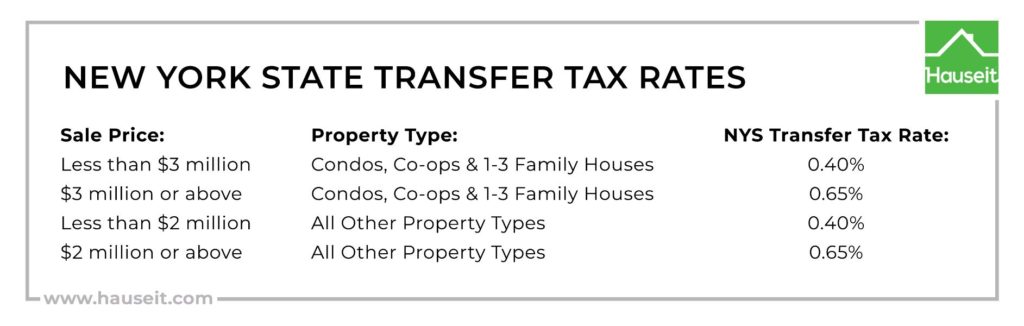

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Property Taxes In Nassau County Suffolk County

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

2021 Florida Sales Tax Rates For Commercial Tenants Winderweedle Haines Ward Woodman P A

Florida Property Tax H R Block

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

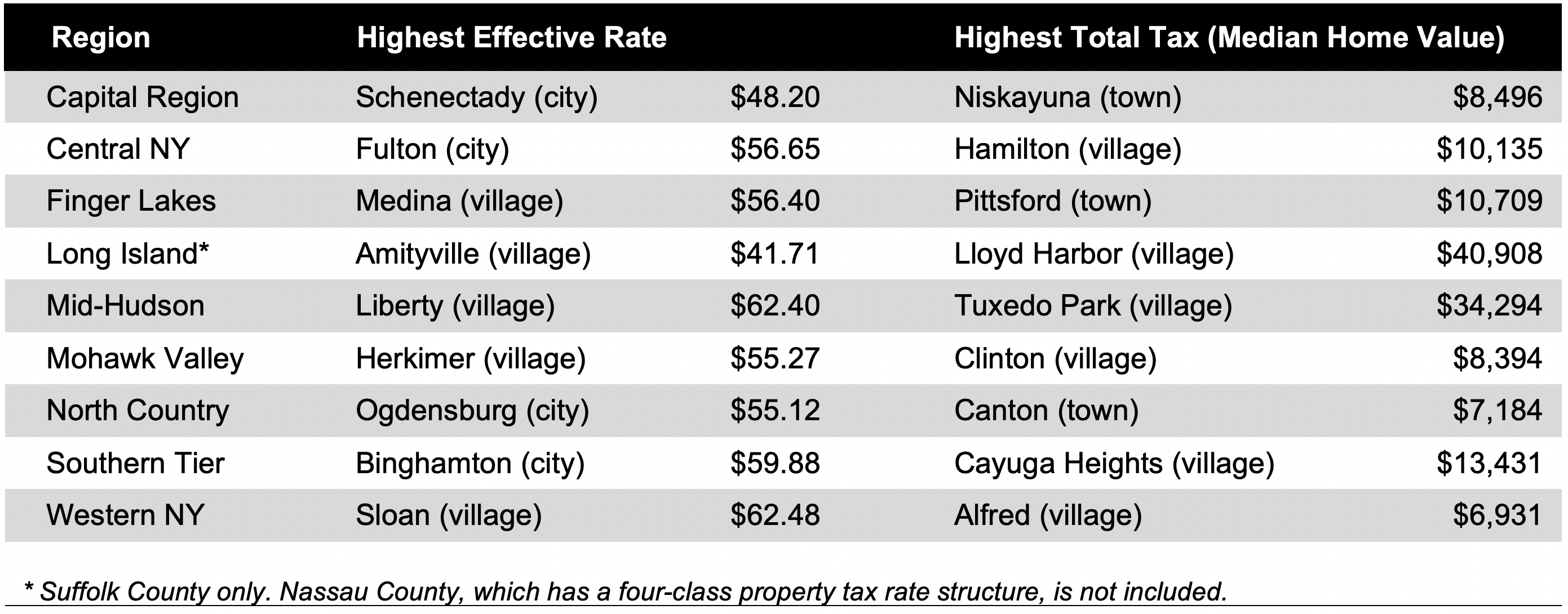

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Taxes In Nassau County Suffolk County

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Property Taxes In Nassau County Suffolk County

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

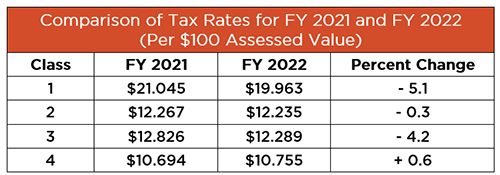

Update To New York City Property Tax Rates Property Taxes United States

5 Fall And Winter 2021 Home Decor Trends To Help Your Listings Stand Out Trending Decor Home Decor Trends 2021 Home Decor Trends