city of san antonio sales tax rate

Participating cities and areas. Rate - 14 002500 Effective - July 1 1991.

California Sales Tax Rate Rates Calculator Avalara

San antonios current sales tax rate is 8250 and is distributed as follows.

/https://s3.amazonaws.com/lmbucket0/media/business/se-military-dr-city-base-landing-4567-1-PN8TuZPqjEPqzlD1rOHZrnsFoQU8miDlxXZR4of8FA8.4c3e4b2a84e1.jpg)

. 1000 City of San Antonio. San Antonio collects the maximum legal local sales tax. San Antonios current sales tax rate is 8250 and is distributed as follows.

City Sales and Use Tax. San Antonio Water System. 1000 City of San Antonio.

City sales and use tax codes and rates. 0125 dedicated to the City of San Antonio Ready to Work Program. 4 rows San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX.

What is the sales tax rate in San Antonio Texas. View the printable version of city rates PDF. Monday - Friday 745 am - 430 pm Central Time.

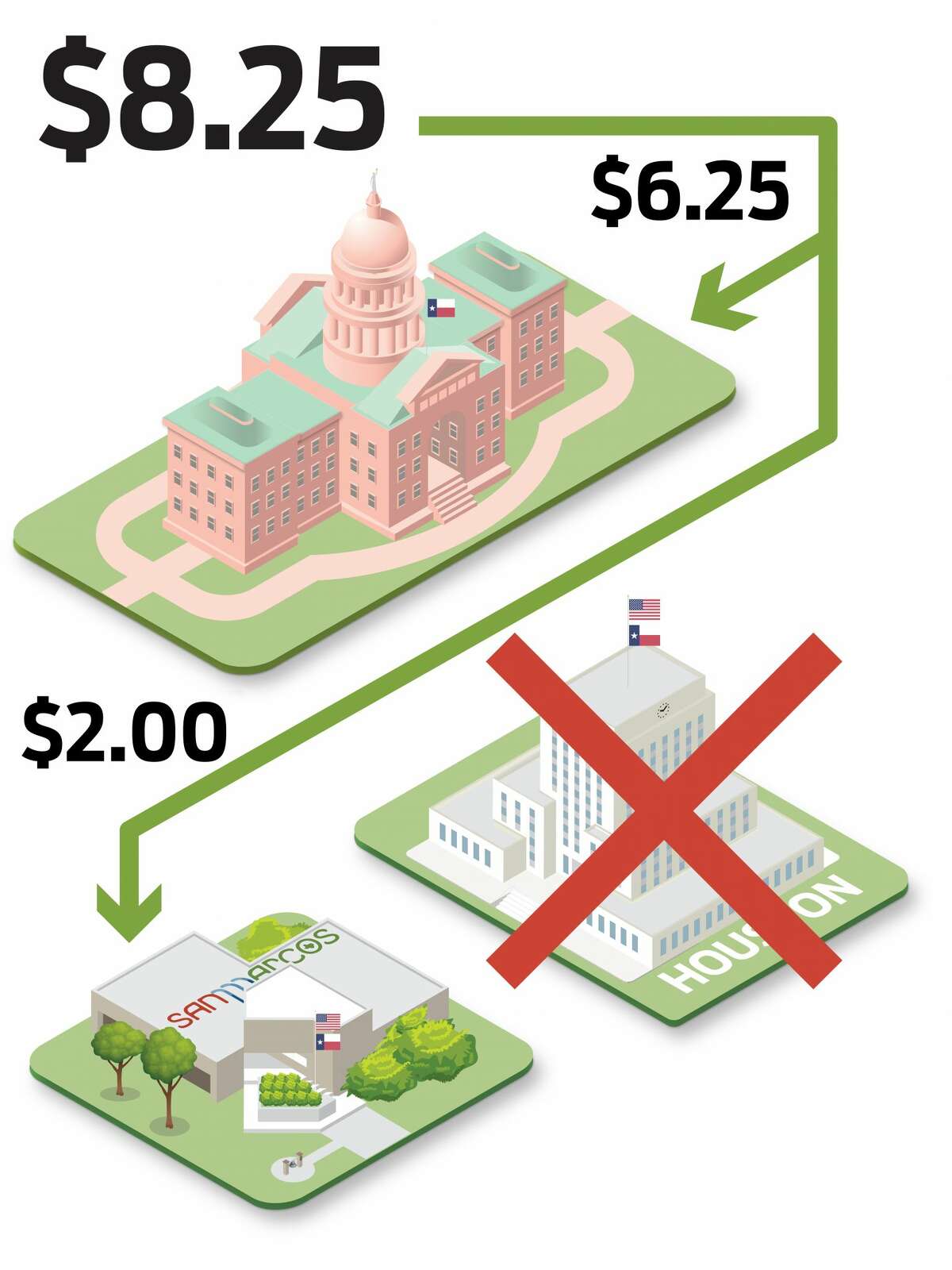

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special. Total City Employee Compensation. 0125 dedicated to the City of San Antonio Ready to Work Program.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a. The minimum combined 2022 sales tax rate for San Antonio Texas is. What is Texass tax rate.

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. Look up the current sales and use tax rate by. City of San Antonio Property Taxes are billed and collected by the Bexar County.

San Antonios current sales tax rate is 8250 and is distributed as follows. San Antonios current sales tax rate is 8250 and is distributed as follows. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

South San Antonio ISD. Texas Comptroller of Public Accounts. The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the Convention Center expansion.

This includes the rates on the state county city and special levels. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax. Please direct these items to the new City Tower location City of San Antonio Print Mail.

Real property tax on median home. The average cumulative sales tax rate in San Antonio Texas is 822. Sales Tax State Local Sales Tax on Food.

San Antonio Water System. Local code - 3015664. San Antonio TX 78283-3966.

Rate - 14 002500 Effective - April 1 2005. The San Antonio sales tax rate is 825. 0125 dedicated to the City of San Antonio Ready to Work Program.

1788 rows For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. San Antonio has parts of it located within. Payday Loans Consumer Info.

This is the total of state county and city sales tax rates. 1000 City of San Antonio.

Local Tax Rates And Exemptions 2018 Texas Cities San Antonio Report

Texas Sales Tax Rate Changes January 2019

Texas Sales Tax Guide For Businesses

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Living In San Antonio 2021 Moving Here Is More Than The Riverwalk And Alamo In San Antonio Texas Youtube

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Property Taxes In Texas What Homeowners Should Know

/shops-at-la-cantera/GGP_091614_Shops_at_La_Cantera_1140x360.jpg)

Texas Tax Back Program In San Antonio The Shops At La Cantera

Millions In Texas Tax Dollars Are Being Diverted To Another Town Or Huge Online Retailers Like Best Buy

/https://s3.amazonaws.com/lmbucket0/media/business/se-military-dr-city-base-landing-4567-1-PN8TuZPqjEPqzlD1rOHZrnsFoQU8miDlxXZR4of8FA8.4c3e4b2a84e1.jpg)

T Mobile Se Mltry Dr City Base Lndg San Antonio Tx

San Antonio City Council Approves 10 Homestead Exemption

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio Heron

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption